Small and large companies continually grapple with the pressing question: Is dedicating resources to risk assessment worth the effort?

In this article, we delve deep into this critical aspect of business operations and shed light on the substantial returns on investment (ROI) that it can offer.

Why Risk Assessment Is Essential for Your Business’s Survival

Investing in risk assessment positively impacts decision making, operations, reputation management, and investor confidence. Let’s go into more detail below:

Risk Assessment Enhances Decision-Making

One of the most compelling arguments favoring risk assessment is its ability to empower organizations to make informed and strategic decisions.

Businesses can proactively develop mitigation strategies by identifying potential risks and their consequences.

This minimizes potential losses and uncovers new opportunities for growth and expansion. Below are some positive ways that risk assessment influences decision-making:

Proactive Approach

Instead of merely reacting to unexpected issues, decision-makers can anticipate potential problems and take measures to prevent or mitigate them.

This proactive stance saves time and resources and ensures smoother and more efficient processes.

Increased Confidence

When decision-makers thoroughly understand the risks involved, it boosts their confidence in the chosen course of action.

They can communicate their decisions more effectively, gain stakeholders’ trust, and navigate challenges with poise.

Legal and Ethical Compliance

In many industries, adhering to legal and ethical standards is non-negotiable. Risk assessment ensures that decisions align with these standards, reducing the likelihood of legal disputes or ethical breaches.

Continuous Improvement

Decision-makers can continuously review and refine strategies based on changing risk factors and outcomes. This commitment to improvement is a hallmark of successful decision-makers.

Risk Assessment Improves Compliance and Reputation Management

Risk assessment helps identify areas where a business may fall short of compliance and enables corrective actions.

Furthermore, a commitment to risk assessment will enhance your company’s reputation as a responsible and trustworthy entity in the following ways:

Regulatory Compliance

Engineering industries operate within a web of intricate regulations and standards. Risk assessment helps these organizations identify and address regulatory risks specific to their field.

By doing so, they can proactively ensure compliance with industry-specific laws and standards, avoiding legal consequences and fostering a culture of integrity.

Safety Standards

Any lapse in safety can lead to catastrophic consequences. Risk assessment is an effective tool for identifying potential safety risks and vulnerabilities in engineering processes.

Addressing these concerns enhances safety standards, minimizing the likelihood of accidents and ensuring compliance with safety regulations.

Quality Assurance

Risk assessment helps companies identify potential quality issues in their products or services.

By addressing these issues, organizations can ensure consistent, high-quality outputs, which, in turn, enhances their reputation for excellence.

Timely Issue Resolution

Incidents and challenges can arise unexpectedly, and when you have the necessary digital safety management tools to foresee potential issues, you can create comprehensive plans for their resolution.

This proactive approach minimizes damage to the company’s reputation and demonstrates a commitment to addressing problems efficiently.

Risk Assessment Increases Operational Efficiency

Risk assessment streamlines operations by identifying inefficiencies and bottlenecks in industries such as oil and gas.

With this information, your company can save costs and improve productivity by making targeted improvements such as:

Proactive Risk Mitigation

By proactively addressing risks, organizations can avoid or mitigate the negative consequences that may arise.

This proactive approach can significantly enhance operational efficiency by reducing disruptions and associated downtime.

Resource Allocation

Through risk assessment, organizations can identify areas where resources can be allocated more effectively.

This could mean reallocating budgets, personnel, or time to optimize various aspects of the operation.

Enhanced Safety and Security

Operational efficiency is closely linked to the safety and security of the workforce and assets.

Risk assessment helps identify vulnerabilities, allowing organizations to enhance safety protocols and ensure smooth operations.

Real-World Example in Manufacturing: A manufacturing company implemented a risk assessment program that identified potential equipment breakdowns.

The company reduced downtime, saved costs, and improved overall efficiency by proactively scheduling maintenance based on the risk assessment.

Risk Assessment Builds Stakeholder Confidence

Regular risk assessment reports demonstrate a commitment to openness and build stakeholder trust in the following ways:

Transparency

When investors have a comprehensive understanding of the risks involved, they are less likely to be caught off guard by unexpected developments, which builds trust in the investment process.

Risk Mitigation

Identifying and assessing risks allows investors to develop strategies for risk mitigation. This proactive approach reassures investors that measures are in place to minimize the impact of adverse events, making investing appear less risky.

Objective Analysis

Risk assessments are typically based on objective data and analysis, made possible by digital safety management tools like FAT FINGER.

This objective approach helps investors see that decisions are grounded in facts and sound methodologies rather than subjective opinions, increasing their confidence in decision-making.

Long-Term Perspective

Risk assessments encourage investors to take a long-term perspective, focusing on the overall risk-return profile of an investment. Investors become more confident in their ability to weather short-term fluctuations and uncertainties by considering the long-term potential.

Regulatory Compliance

Regulatory bodies require companies to provide comprehensive risk assessments. This compliance with legal and regulatory standards reassures investors that the investment is being made in a controlled and responsible manner.

Risk Communication

Effective risk assessments often include clear communication of findings to investors. When they receive clear and concise information about risks and mitigation strategies, it helps them make more informed decisions and feel more confident about their choices.

Continuous Monitoring and Crisis Preparedness

Investors gain confidence when they see the management team actively tracking and responding to potential risks. You can boost confidence by planning for potential crises or adverse scenarios.

Reap the ROI of Risk Investment with FAT FINGER

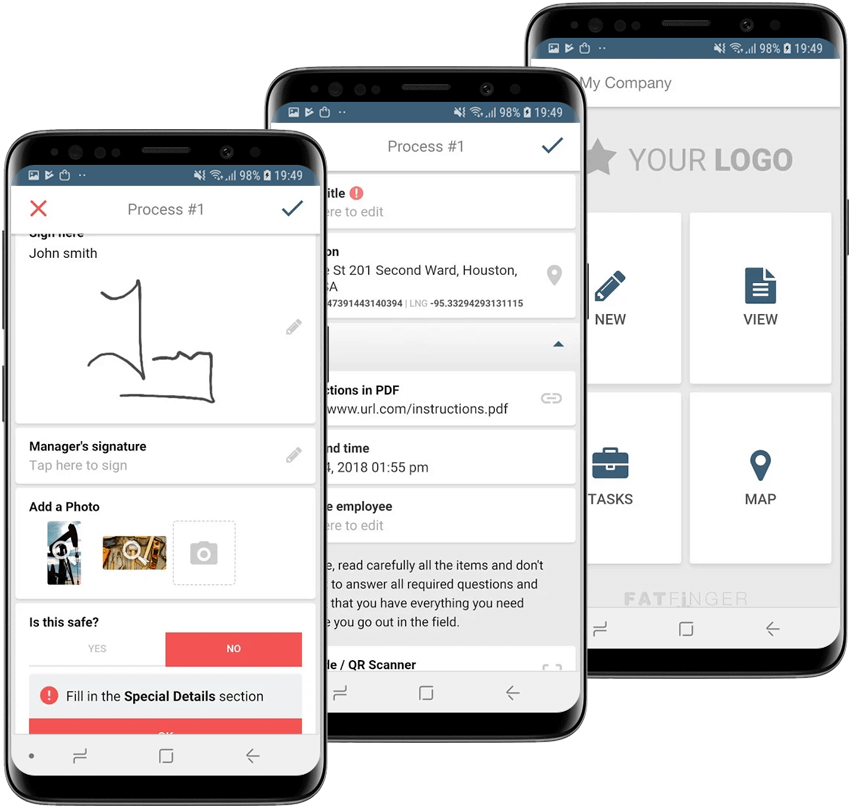

Digitize risk assessment and bolster your business’s decision-making process, streamline operations, increase investor confidence, and achieve long-term sustainability and growth.

Why Use FAT FINGER

Organizations that use manual safety management procedures are:

- 60% more likely to make mistakes

- Experience 62% more accidents.

FAT FINGER will help you measure relevant metrics, capture valuable data, and improve safety protocols to protect employees, assets, and the environment.

The drag-and-drop editor in FAT FINGER lets you easily customize existing safety processes or build your own from scratch.

Once you’ve built a workflow, anyone in your company can access it on their mobile phone and file incident reports, which you can view, comment on, or act on in real-time.