Risk assessment is a critical process for organizations across various industries, helping them identify and manage potential risks that could impact their operations, reputation, and legal compliance.

In this article, we will delve into the legal and compliance aspects of risk assessment, exploring its purpose, methodologies, tools, and best practices.

Understanding Risk Assessment

Before we delve into the legal implications, let’s understand what risk assessment entails. Risk assessment is the systematic process of identifying, evaluating, and mitigating potential risks that an organization may face.

It involves a thorough analysis of internal and external factors that could jeopardize a company’s operations.

Types of Risk Assessment

There are various types of risk assessments, each tailored to specific needs:

Operational Risk Assessment: Focuses on identifying risks related to daily operations, including process failures, supply chain disruptions, and technology issues.

Financial Risk Assessment: Evaluates financial risks such as market volatility, credit risks, and liquidity concerns.

Compliance Risk Assessment: Assesses an organization’s adherence to regulatory requirements, ensuring it operates within the boundaries of the law.

Strategic Risk Assessment: Examines risks associated with an organization’s long-term goals and strategic decisions.

Information Security Risk Assessment: Concentrates on identifying and mitigating cybersecurity threats and data breaches.

Legal Implications of Risk Assessment

1. Compliance with Regulatory Requirements

Many industries are subject to a web of regulations aimed at ensuring safety, fairness, and ethical conduct. Neglecting risk assessment can lead to non-compliance with these regulations, setting the stage for legal troubles.

Regulatory bodies such as the International Labor Organization (ILO), Occupational Safety and Health Administration(OSHA), and the Environmental Protection Agency (EPA), have stringent requirements that organizations must adhere to.

Failure to do so can result in hefty fines, penalties, and even the suspension of business operations. It’s essential for businesses to stay up-to-date with the evolving regulatory landscape and integrate compliance into their risk assessment processes.

2. Negligence Lawsuits

Negligence is a fundamental legal concept that often comes into play when risk assessment is overlooked. If an organization’s negligence leads to harm, injury, or financial losses for stakeholders, they may file negligence lawsuits seeking compensation.

These lawsuits can be costly and time-consuming, diverting valuable resources away from core business activities. Neglecting risk assessment can make it challenging for organizations to defend against such claims, as it becomes evident that they failed to exercise the duty of care expected in their industry.

3. Financial Consequences

Financial consequences are perhaps the most immediate and palpable result of neglecting risk assessment.

Risks that go unaddressed can materialize unexpectedly, leading to substantial financial losses. These losses can affect your organization’s profitability, cash flow, and shareholder value.

Moreover, financial setbacks can hinder growth, making it difficult for the company to invest in innovation, expansion, or employee development. In some cases, businesses may even face bankruptcy if they cannot recover from the financial blow.

4. Criminal Charges

While not common, neglecting risk assessment can escalate to criminal charges in extreme cases. This typically occurs when negligence involves fraudulent activities or intentional misconduct.

For example, intentionally concealing safety data resulting in harm to workers or customers could result in charges being filed against company executives.

The potential consequences of criminal charges extend beyond financial penalties and can include imprisonment, further damaging the company’s reputation.

5. Shareholder Litigation

Shareholders invest in companies with the expectation of returns and stability. Neglecting risk assessment can lead to shareholder dissatisfaction and a loss of confidence in the company’s management.

In response, shareholders may initiate litigation against an organization’s leadership, claiming mismanagement or failure to protect their investments.

These lawsuits can be highly publicized and can result in substantial financial settlements, putting additional strain on the company’s resources.

6. Insurance Implications

Neglecting risk assessment can also have repercussions in the realm of insurance. Many businesses rely on insurance policies to protect themselves from unforeseen events.

7. Ethical and Moral Obligations

Beyond the legal framework, organizations have ethical and moral obligations to their stakeholders and society as a whole.

Neglecting risk assessment can breach these obligations, leading to public backlash and social consequences. Ethical misconduct, even if not resulting in legal action, can damage an organization’s reputation irreparably.

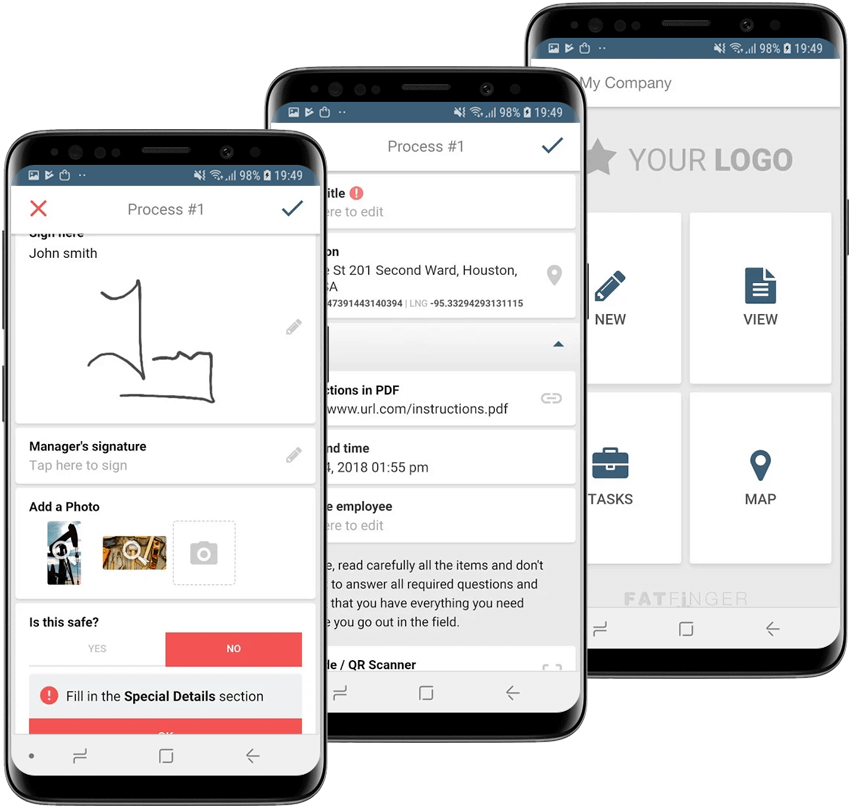

Empower Front Line Teams with FAT FINGER

Incident reporting is critical to safety management. But ensuring workplace safety can be overwhelming without the right tools.

Organizations that use manual safety management procedures are:

- 60% more likely to make mistakes

- Experience 62% more accidents.

FAT FINGER’s digital safety workflows solve this problem, allowing organizations to:

- Prevent accidents

- Ensure compliance with regulations

- Foster a safety culture.

The drag-and-drop editor in FAT FINGER lets you easily customize existing safety processes or build your own from scratch.

Once you’ve built a workflow, anyone in your company can access it on their mobile phone and file incident reports, which you can view, comment on, or act on in real-time.

FAT FINGER will help you measure relevant metrics, capture valuable data, and improve safety protocols to protect employees, assets, and the environment.