ESG governance has become more significant in recent years as consumers are increasingly interested in how their products are made. Environmental audits and inspections are one of the

critical priorities in ESG in attaining the common goal of conducting business in an ethical and fair manner.

Table of Contents:

1. What is ESG?

2. What are the ESG Factors?

3. Benefits of ESG Governance for Companies

4. Get Started with ESG Governance in your Workplace

5. FAT FINGER as your ESG Partner

What is ESG?

ESG governance is a corporate management approach that considers environmental, social, and governance (ESG) factors to create value for shareholders. ESG governance is also known as sustainable, responsible, or impact investing. ESG governance aims to create long-term value for shareholders by considering how a company’s operations and strategies will impact ESG factors.

ESG Governance is essential because it helps companies identify and manage risks associated with ESG factors. It also helps companies capitalize on opportunities to create value from ESG initiatives. ESG Governance is particularly relevant for engineering companies because they often directly impact environmental and social issues.

Engineering companies can use ESG Governance to mitigate risks associated with climate change, water scarcity, air pollution, employee safety, customer satisfaction, and community relations. ESG Governance can also help engineering companies identify opportunities to create value from sustainability initiatives. For example, a company might develop new products or services that address environmental or social challenges. Or a company might implement operational efficiencies that reduce its ecological footprint.

ESG Governance is an essential tool for engineering companies that want to create value for shareholders while positively impacting the world.

What are the ESG Factors?

ESG factors take into account a company’s impact on the environment and society, as well as its Governance structures and policies. The three pillars of ESG are environment, social, and governance.

1. Environmental considerations include a company’s impact on climate change, water scarcity, and air pollution. Corporate environmental engineering can help assess and identify a company’s potential physical and climate risks. This information can help inform corporate decision-making to minimize environmental impacts.

2. Social considerations in ESG include a company’s impact on employees, customers, and communities. A company’s human capital management policies, labor practices, and customer service procedures all fall under the social category of ESG. For example, a company that engages in responsible human capital management practices, such as providing fair wages and good working conditions, is likely to be viewed favorably by ESG investors. Similarly, a company seen as a force for positive change in its community, such as charitable giving or volunteer initiatives, is also likely to be viewed favorably. ESG investing is about more than just environmental issues; it is about finding companies making a positive impact on the world.

3. Governance considerations include a company’s board of directors, executive compensation, and bribery & corruption policies. In addition, ESG factors can also affect a company’s relationships with its stakeholders, including customers, employees, and investors.

Companies need to have clear and robust ESG policies in place. These policies should be designed to promote transparency and accountability, and to ensure that ESG considerations are given the attention they deserve.

Benefits of ESG Governance for Companies

ESG (environmental, social, and governance) factors are increasingly important in corporate governance. ESG has become an essential consideration for companies, as investors are increasingly interested in ESG factors when making investment decisions. There are numerous benefits to incorporating ESG considerations into corporate governance.

1. Attract and retain investors. ESG-conscious investors prefer investing in companies that consider ESG risks and opportunities. By incorporating ESG into corporate governance, companies can make themselves more attractive to ESG-conscious investors.

2. Improve financial performance. ESG considerations can help to identify risks and opportunities that may impact financial performance. For example, if a company is not considering environmental hazards, it may be exposed to significant financial risks. By incorporating ESG into corporate governance, companies can make informed decisions that may help to improve financial performance.

3. Build brand value and reputation. Companies seen as leaders in ESG can build a strong reputation and brand value. This can help to attract customers and business partners, as well as to attract and retain employees.

4. Drive innovation. Addressing ESG risks and opportunities can lead to new products, processes, and business models. For example, a company looking to reduce its environmental impact may develop new products or more environmentally friendly strategies.

In sum, ESG governance offers numerous benefits for companies, making it an essential consideration for any forward-thinking organization.

Get Started with ESG Governance in your Workplace

ESG has become an essential consideration for companies, as investors are increasingly interested in ESG factors when making investment decisions. There are numerous benefits to incorporating ESG considerations into corporate governance.

1. Review your company’s existing policies and procedures. ESG governance involves ensuring that all aspects of your company’s operations align with ESG values. This means looking closely at everything from your supply chain to employee benefits. Once you have a good understanding of where your company stands, you can start to develop an implementation plan.

2. Decide which ESG criteria are most relevant to your company and goals. There are many different ESG indicators, so it is essential to choose the ones that will give you the most insights into your company’s ESG performance. ESG criteria vary as follows:

Environment – air quality and pollution, carbon emissions, energy efficiency, water management, waste management.

Social – human rights, community relations, fair labor practices, employee engagement, consumer welfare, privacy protection.

Governance – tax transparency, crisis management, bribery and corruption, business ethics.

3. Monitor results and evaluate progress. Make changes as needed to ensure that you progress towards your goals. ESG governance is not a one-time event but an ongoing process that should be integrated into all aspects of your company’s operations. You will need to put together a team to oversee your company’s ESG governance efforts

ESG governance is an essential topic for companies today. By taking these steps, you can ensure that your company is doing its part to create a sustainable future.

FAT FINGER as your ESG Partner

When it comes to ESG, there are a lot of moving parts. You want to make sure you’re doing everything you can to make progress, but it can be tough to keep track of everything. It’s hard enough to keep up with all the environmental and social regulations, let alone trying to figure out how your company can reduce its environmental and ethical impact.

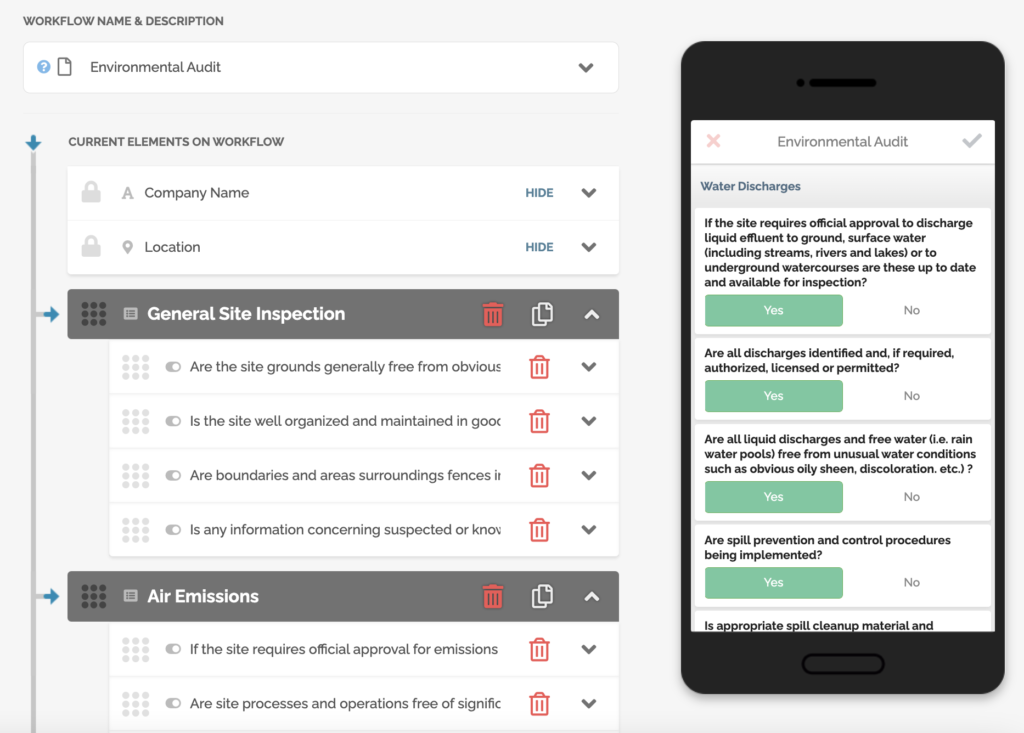

That’s where we come in. FAT FINGER is here to help you with your ESG journey. We offer a digital checklist that covers all the ESG basics, from environmental to social to governance. We’ll help you make sure you’re on track and doing everything you can to make progress.

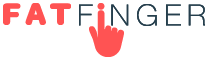

With FAT FINGER app, you can take action towards a better ESG score and make long-term changes that investors and consumers will notice.FAT FINGER is a powerful tool with features that include:

-Perform inspections, audits, and assessment anytime and anywhere with the mobile app to ensure that ESG best practices are being maintained.

-Measure your ESG performance by keeping a record of ESG KPIs over time. Get real-time alerts when ESG issues arise so you can take corrective action quickly.

-Share ESG reports with investors, analysts, and other stakeholders to show them your company’s progress.

-Create automated workflows to ensure work is done correctly every time.

-Communicate across any device. All your up-to-date work instructions and training contents are available on the cloud.

Get started today and see how we can help you take your ESG efforts to the next level.

About FAT FINGER:

Ensure front-line teams do their work correctly every time. Drag & drop digital procedures that unlock operational excellence.In seconds anyone can build and deploy enterprise-grade mobile applications using an easy drag-and-drop no-code builder.

FAT FINGER uses machine learning to coach app users in real-time to make safer and improved decisions.Try building your digital procedure on FAT FINGER for free @www.fatfinger.io